A Tax Code that Works as Hard as our Equipment

Section 179 of the United States Internal Revenue Code is a provision that permits businesses to expense the full cost of qualifying equipment purchased or financed and put into operation during the tax year. The goal of this incentive is to encourage businesses to invest in themselves by upgrading or expanding their operations through equipment acquisitions. This tax deduction is upfront, with the goal of stimulating economic growth, boosting productivity, and providing businesses with financial flexibility.

What can Section 179 do for your business?

Free up capital: Your business can deduct the full price of qualifying equipment, immediately, if placed into service before December 31st. This deduction can assist your business in freeing up capital that can be reinvested into other operations.

Improved financial health: When utilizing Section 179 on equipment, your business can reduce its taxable income. Ultimately lowering the company’s tax liability.

Variety: Section 179 covers a variety of equipment, including but not limited to; machinery, vehicles, computers, software and more. This allows for multiple industries to take advantage.

Financial stability and growth: When tax payments are reduced, saved capital can be reinvested. This can improve your cash flow.

Secure your savings before the end of the year. Utilize Section 179 with FLIFT.

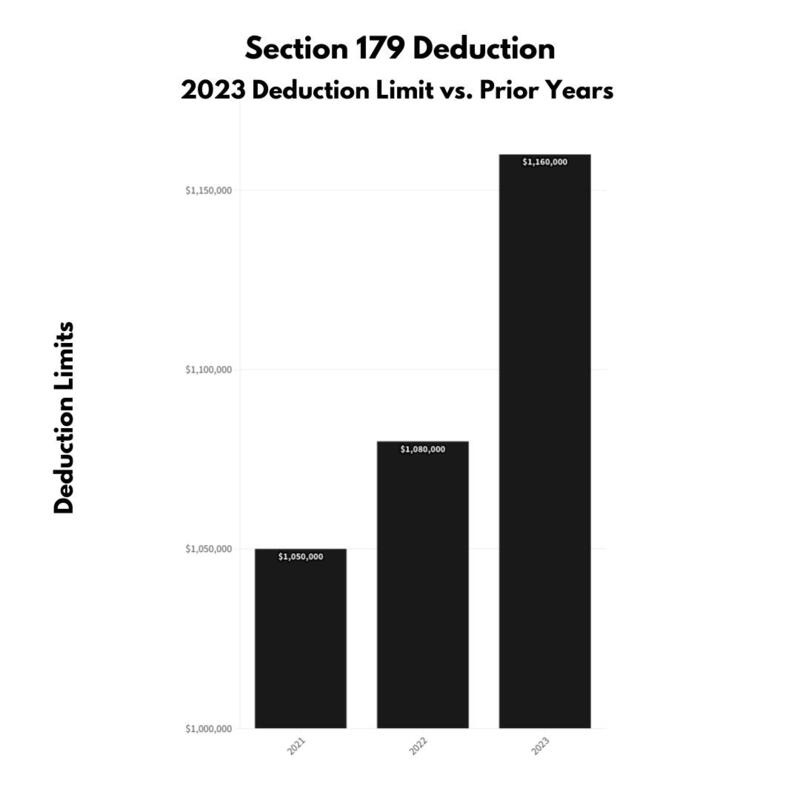

Deduct the cost of qualifying equipment up to $1,160,000, rather than depreciating the cost over a period of years. The maximum dollar amount of equipment you can purchase in any calendar year is $2,890,000 before the deduction is reduced dollar for dollar.An 80% bonus depreciation can be taken on new and used equipment purchases, in addition to the Section 179 deduction